The localization of Colombia is an extension of the core modules adding the necessary functionalities so that companies can operate their accounting and finances in Odoo, complying with the main tax requirements in Colombia.

Electronic invoicing for Colombia is available since Odoo version 12.

The native scope of Odoo covers the main tax requirements of Colombian regulations. Among the scopes are:

Management of Law Withholdings (IVA, Rte IVA, Rte ICA, Rte FTE).

Self-retention management.

Management of withholding rules by third parties through fiscal positions.

Reports for third-party accounting: third-party balance, trial balance, general ledger, daily ledger.

Key definitions

What is electronic invoicing?

The electronic invoice is a functional equivalent to a paper invoice and guarantees the purchase-sale of a good or the loan of service, allowing the taxpayer to check their income and expenses.

Carvajal

It is the technological provider for electronic invoicing in Colombia, it is in charge of validating the XML file, adding the CUFE and the electronic signature, and sending it to the DIAN

DIAN

The DIAN (National Tax and Customs Directorate) is the tax body that in this case is responsible for reviewing, validating, and accepting or rejecting the invoices issued.

Financial CEN

The Financial CEN is the website of the technology provider (in this case Carvajal) where users can validate the invoices issued from the system.

The electronic invoicing process with Odoo

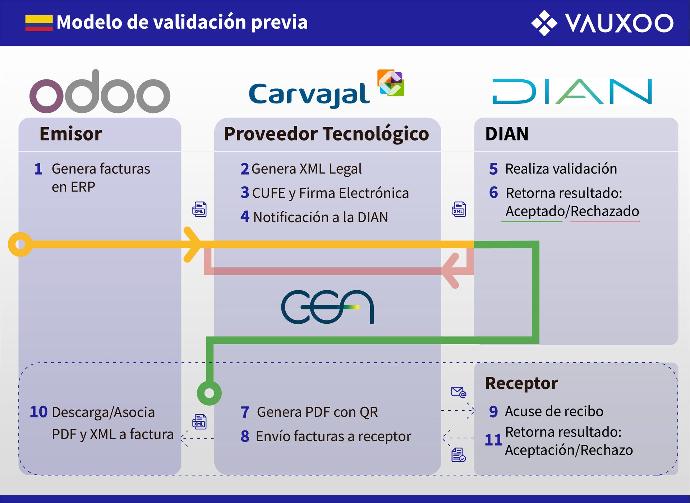

The electronic invoicing process with Odoo consists of 11 phases, starting with the generation of invoices by the issuer until the receiver receives the invoice.

Odoo

The process with Odoo begins when an electronic invoice is generated, an XML file is generated, and contains a series of data that complies with a structure defined by the DIAN, such file has fiscal and legal validity and is considered as physical proof that an operation was carried out correctly and satisfactorily.

Carvajal

After the XML file is generated it is sent to the technology provider (Carvajal) through the web service, the technology provider receives the legal XML and adds the CUFE (Unique Electronic Billing Code) and the electronic signature, In addition to performing a first validation of the structure of the XML file and the specific fields, after this validation, a notification is sent to the DIAN by means of an XML file.

DIAN

The DIAN receives the XML file from the technology provider and generates a second validation of the file structure and returns the result whether it is accepted or rejected. If accepted, the file is sent back to the technology provider, who generates a PDF with QR and sends the invoices to the recipient.

Financial CEN

Once the invoice is sent to the recipient, a call is made to the Financial CEN, and a folder containing the PDF and XML is downloaded. Finally, after receiving the invoice, the Receiver must send an acknowledgment of receipt indicating commercial acceptance or rejection.

Electronic invoicing is a necessary process for any company to comply with its tax obligations correctly, making use of a tool like Odoo will automate your accounting processes and keep your company's tax obligations in order.