The SAT published the 2.0 bill of lading complement, its use being mandatory as of January 1 for Mexican companies, in this blog we tell you what you need to know about the complement and how to integrate it into your Odoo system.

What is the Carta Porte?

It is a digital fiscal document that is issued to protect the transfer of merchandise in national territory, to which the Carta Porte complement is incorporated.

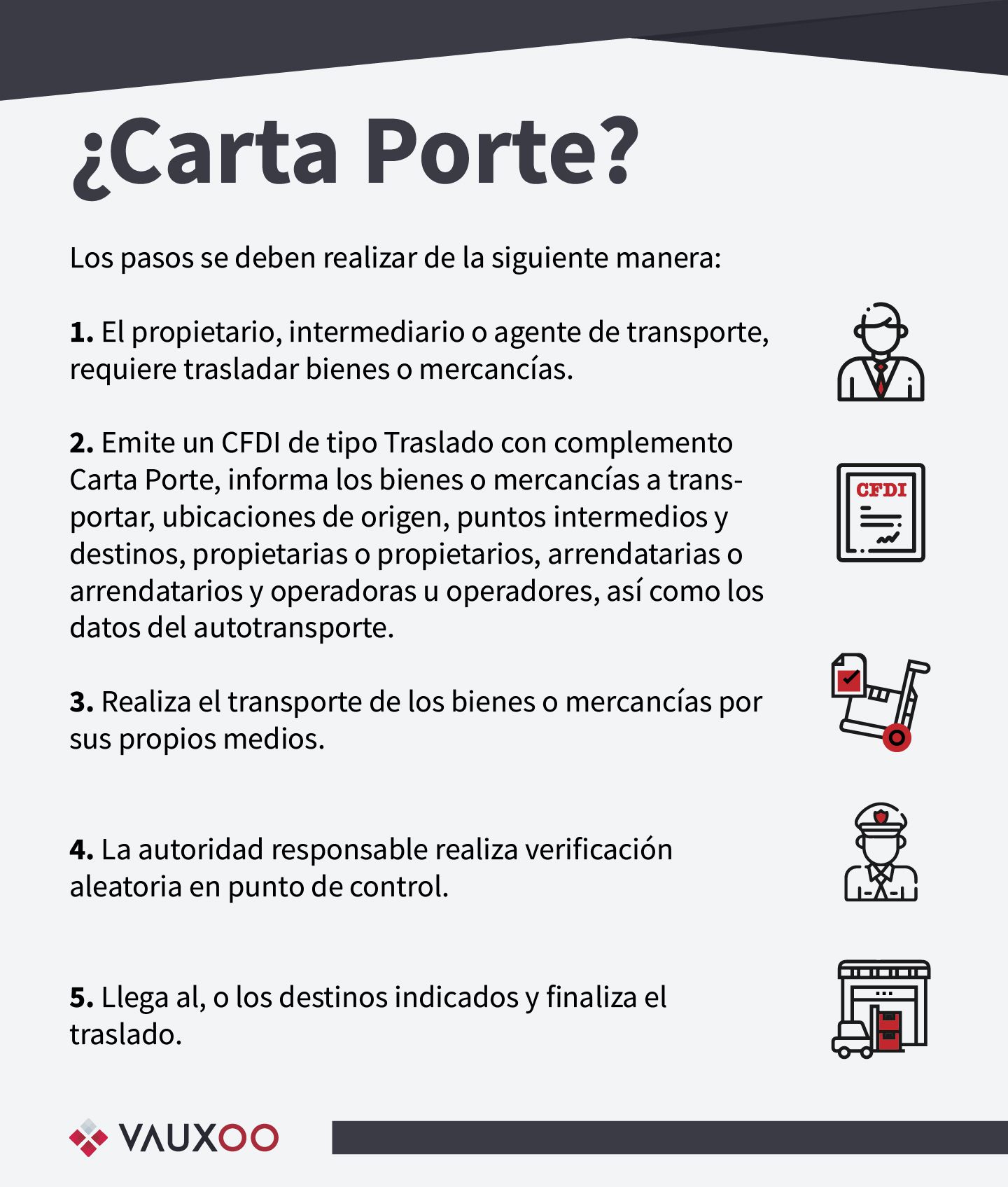

Steps to issue the transfer-type CFDI:

When is the complement used

You must issue an Income-type CFDI with a Carta Porte complement with everything related to the goods or merchandise, origin locations, intermediate points and destinations, as well as the means by which they are transported; whether by land, air, sea or river, here are some cases in which you should use this add-on.

If you dedicate yourself to the transfer of goods or merchandise, issue an Income-type CFDI with Carta Porte complement and cover the collection for the service you are providing, as well as the transfer within national territory.

If you are hired to transport merchandise from one place to another, within the same city (you do not use federal highways), you must issue an electronic invoice of the Income type with the Carta Porte complement.

If you are the owner of the goods or merchandise or act as an intermediary or transport agent and need to move merchandise, issue a Transfer-type CFDI with Carta Porte complement and cover the transfer through national territory.

If you are the owner of the goods or merchandise, and you need to transfer them with your own means from one place to another, within the same city (you do not use federal highways), you must issue an electronic invoice of the Transfer type with the Carta Porte complement.

When does its mandatory use by the SAT come into force?

The Carta Porte version 2.0 supplement was published on the SAT portal on October 26, 2021.

The beginning of validity of the Carta Porte version 2.0 supplement will be from January 1, 2022, but there is until March 31, 2022 as a transition period to correctly issue the CFDI to which this supplement is incorporated without fines and sanctions. This according to what is established in the second operative paragraph, published in the 1st. Early version of the 4th. Resolution of Modifications to the RMF in relation to the Eleventh Transitory, published in the 1st. Early version of the 3rd. Resolution of Modifications to the current RMF and is applicable to all obligated subjects.

In Odoo can I issue the Carta Porte?

That's right, Odoo is working to have the official version released before January 1 2022, and will continue working on the updates that it requires.

The invoice issuance service may stamp the bill of lading 2.0.

The 2.0 consignment add-on that Odoo will release is only for versions 13, 14 and 15, if you are interested in implementing it in previous versions, we can help you!

Do you want to know more about how to implement the bill of lading complement in your billing?

Contact with one of our experts!