In this blog post, we will explain what is CFDI? What is PAC? What is the electronic invoicing process like? And how to streamline this process with a very simple tool.

Since 2014, electronic invoicing became mandatory for all taxpayers in Mexico registered with the SAT, and since 2017 the version 3.3 of the CFDI was originated to have greater control and provide a better service to the taxpayer. But not everyone fully understands the electronic invoicing process and for some, it is still difficult to understand.

What is electronic invoicing?

Let's start with the main thing, invoicing is about the accounting movements of customers and suppliers in a business. It indicates the purchase or sale of a product or service between two parties, it includes all the information of said operation, it has fiscal and legal validity and it is considered as physical proof that an operation was carried out correctly and satisfactorily. While an electronic invoice or better known as CFDI (Digital Tax Receipt by Internet) is an XML document that verifies a transaction between seller and buyer.

When an electronic invoice is made, an XML file is being generated, there are a series of detailed data that comply with a specific structure and with the standards defined by the SAT, this file has fiscal relevance and is the electronic format used to represent all fiscal operations.

To issue tax receipts you can make use of electronic invoicing software, these systems simplify the entire process, for example, we have Odoo Accounting that takes care in a simple way to generate the XML file.

PAC

After generating the XML file, a very important part of the process begins, which is to send it to your PAC.

A PAC (Authorized Certification Providers) is an entity that has the authorization of the SAT (Tax Administration Service) to verify and validate the structure of the XML, it ensures that the information is correct before reaching its servers.

The main task of a PAC is to validate the CFDI, assign a folio, and incorporate a tax stamp and at the time of validation, it ensures that all the information of the issued tax receipts reaches the SAT.

Stamp duty

In the last step, it is time for the PAC to generate the stamp and then send it to the SAT, this is nothing more than a digital seal, in order to validate its authenticity.

What is Odoo Accounting, and how can it help me to do this easily?

Odoo Accounting is a module of the Odoo application suite that since 2017 contains the Mexican Location, it has a series of functionalities developed in Odoo to make it fiscally suitable to operate in Mexico.

Within this application, companies operating in Mexico that are legally registered can send invoices in the CFDI format, which is the one that allows any invoice to be certified and stamped.

The invoicing process becomes simple, for example:

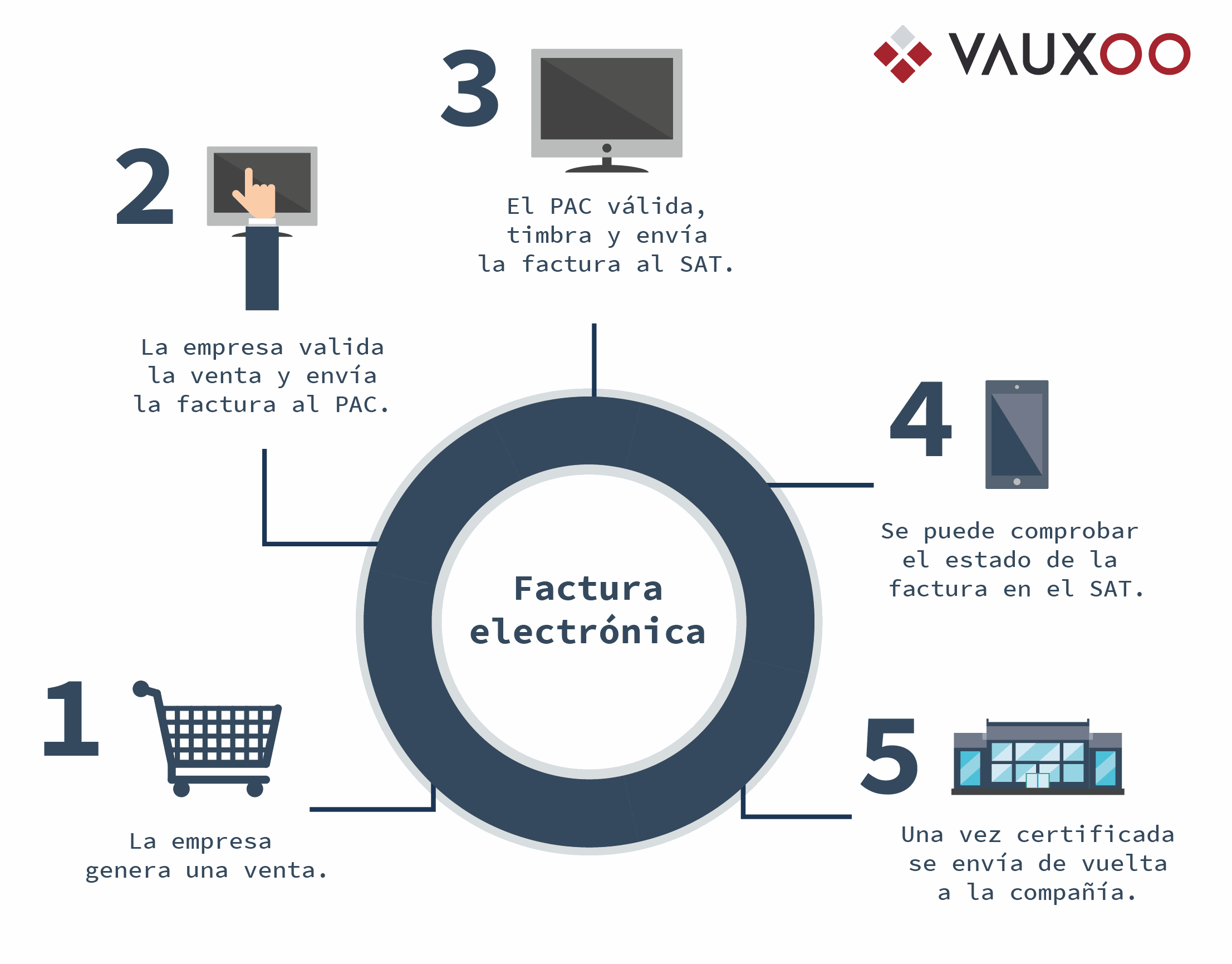

Your company generates a sale, having all the data well structured.

The company validates the sale and sends the invoice to the PAC, through Odoo.

The PAC is in charge of validating, stamping, and sending the invoice to the SAT.

Once the invoice is certified, it is sent back to the company.

The customer can check the status of the electronic invoice on the government website before making any payment.

Is there a limited amount of stamps in Odoo?

The number of stamps does not depend on Odoo, since the Mexican Location was integrated, it began to work with 2 different PACs (Quadrum and SolucionFactible) which have different forms of collection for tax stamps, in Quadrum pyou pay only what you consume at the end of the 30-day period, while in Solucion Factible you must buy a package with a certain number of stamps depending on what you need.

Electronic invoicing has a fairly simple process to understand, and once you have understood it, you have the opportunity to decide using a tool that makes your work easier, such as Odoo Accounting.